charitable gift annuity rates

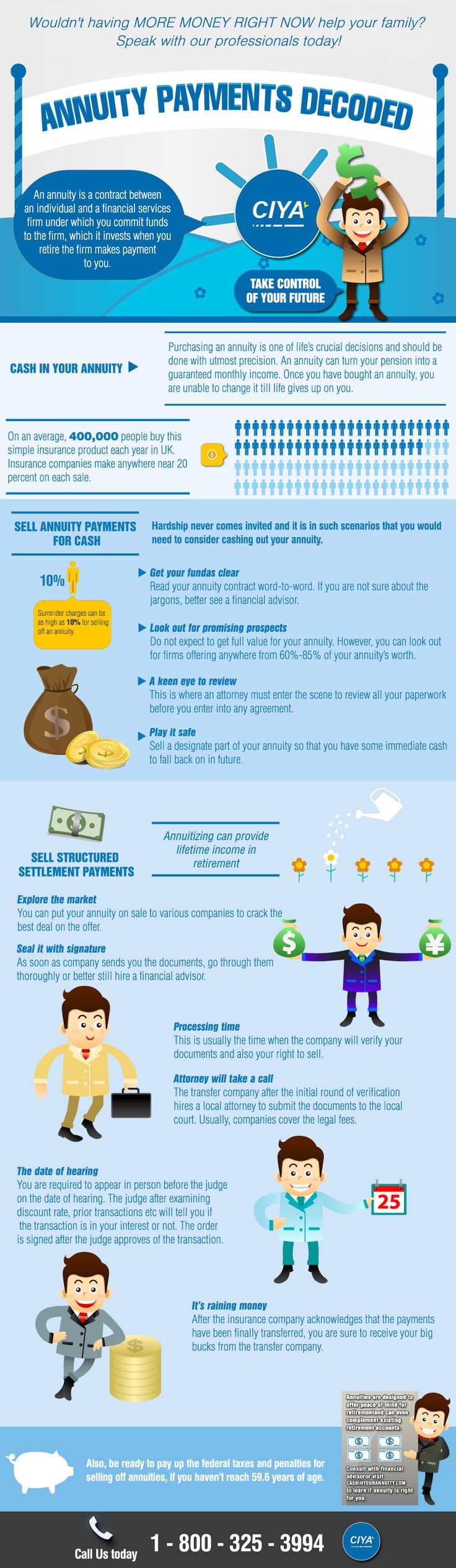

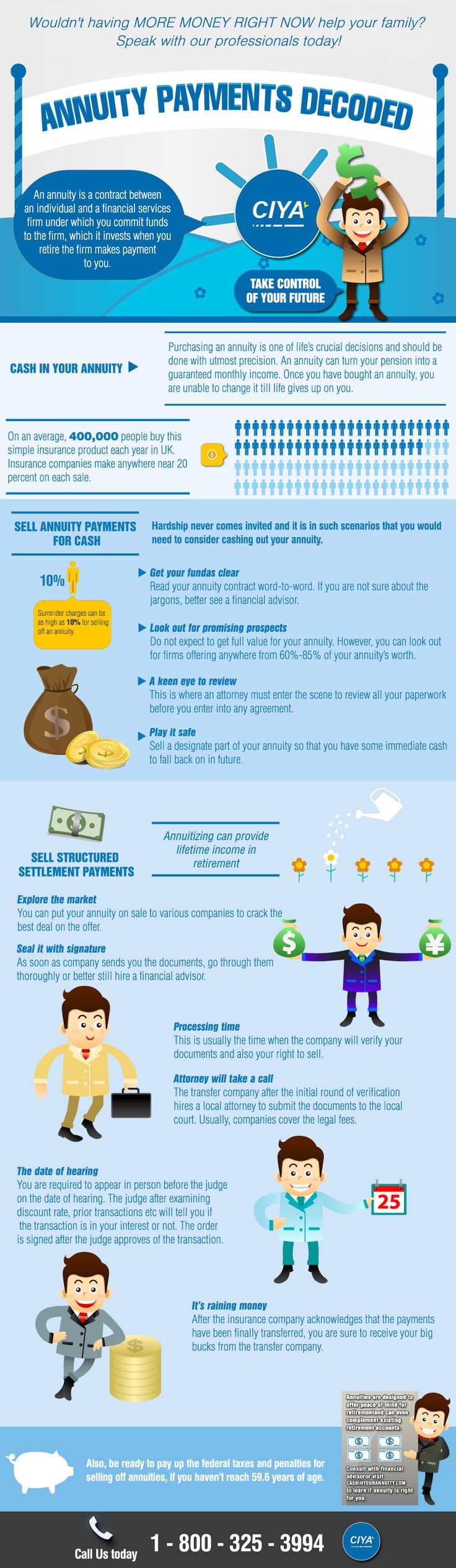

Annuities are often complex retirement investment products. In exchange the charity assumes a legal obligation.

Ad Givelify is the most widely-used charitable giving platform for nonprofits.

. The American Council on Gift Annuities ACGA recently announced new suggested maximum charitable gift annuity rates effective July 1 2020. Simply input the amount of your possible gift the basis of. A charitable gift annuity is a contract between a charity and a donor that in exchange for an irrevocable transfer of assets to the charity the charity will pay a fixed sum to the donor andor.

Alternatives to Charitable Gift Annuities. Immediate Payment Annuity current rates Age. Charitable gift annuity rates vary from charity to charity and are based on several factors including the amount of the gift as well as the donors ages at the time of the gift.

The platform offers complete donation management tracking and integration. The initial investment may be as little as 5000. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators.

It sets the rates by. The minimum required gift for a charitable gift annuity is 10000. Although charitable gift annuities can be a valuable tool they may not be the right choice for every investor for a variety of reasons.

Ad Get Free Quotes From 31 Top Rated Companies. Based on response to our most recent article on charitable gift annuities and feedback from thousands of our readers Annuity FYI has assembled a list of the Top 40 reader-recommended. For many charitable organizations the minimum required gift for an annuity is 10000 or more.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Annuities are often complex retirement investment products. Browse Get Results Instantly.

The amount of your payments is based on your age and the current interest rate. You can contribute cash or securities to Consumer Reports for a charitable gift annuity and in return receive fixed-rate lifetime annuity payments and a. Charitable Gift Annuity Payment for a 10000 Gift.

Learn some startling facts. Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years. Ad Search For Info About Charitable gift annuity rates.

SUGGESTED CHARITABLE GIFT ANNUITY RATES Approved by the American Council on Gift Annuities Effective April 26 2021. Little-Know Tips You Absolutely Must Know Before Buying An Annuity. Ad Want a Safer Way to Invest in Your Financial Future.

See Finance Institutions With Top Offers. The American Council on Gift Annuities ACGA is pleased to share our progress in working with regulators in New York State regarding maximum allowable charitable gift annuity payout. The above gift annuity rates are based on the American Council On Gift Annuities suggested rates effective July 1 2020.

125 rows For immediate gift annuities these rates will result in a charitable deduction of more than 10 if the CFMR is 06 or higher whatever the payment frequency. For example if you are 60 years old and donate 1000 to a charity with a current interest rate. 7 rows Many charities require a minimum 10000 to 25000 initial donation to fund the annuity.

A Guideposts Charitable Gift Annuity allows you to make a gift now gain tax benefits and receive payments for life. Although in most cases this would be. Fixed Payments Eliminate The Impact Of Market Volatility.

Charitable Gift Annuity Rates Rates Effective as of January 1 2012 SINGLE LIFE AGE RATE AGE RATE AGE RATE AGE RATE 55 56 57 58 59 60 61 62 63 40 41 41 42 43 44 44. Compare Fixed Variable Rate Annuity Accounts. For more information please.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. It is possible to fund a charitable gift annuity with cash securities or any other asset. Annuities May be the Answer.

Learn some startling facts. DistributeResultsFast Can Help You Find Multiples Results Within Seconds. The ACGAs new single-life rates are 04 to 05 lower than the rates that went into effect on January 1 2020 and the new two-life rates are 03 to 05 lower.

Up to 25 cash back The interest rates are suggested by the American Council on Gift Annuities ACGA a nonprofit organization that promotes these annuities. In the case of immediate income annuities to donors in their seventies or older the charity may be able to obtain the life annuities at a 35 to 50 percent discount. A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity.

Two Lives Joint Survivor Younger Age Older Age Rate. This well-established and IRS-approved form of giving helps you boost your. Learn More About Annuities.

The ACGA suggested rate schedule is designed to result in a residuum of at. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

Article Jobs Asperger S A Plus Aspergers Job How To Apply

Annuity Annuity Life Insurance Marketing Marketing Humor

Logo Metlife Logo Top Web Designs Web Design Projects

20 Dividend Stocks To Fund 20 Years Of Retirement Dividend Stocks Dividend Dividend Investing

The End Of The Year Is Approaching Please Consider The Many Ways You Can Enjoy Tax And Income Benefits While Also Helping State University Enjoyment Income

Does A Charitable Gift Annuity Make Tax Sense For You Annuity Charitable Gifts Charitable

Allstate Loses 1 08 Billion In Claims On The Business Side Allstate Needs To Be Profitable As A Comp Farmers Insurance Insurance Industry National Insurance